“The difference between the 2022 and 2023 filing seasons … like night and day,”

– Erin M. Collins

You, or one or more people you know, suffered through the 2022 tax filing season … refund and return processing delays, correspondence processing holdups, and difficulty reaching the IRS by phone.

The Good News!

National Taxpayer Advocate Erin M. Collins released her statutorily mandated 2024 Objectives Report to Congress. She wrote in her introduction to the report, “In submitting this report, I’m finally able to deliver some good news: The taxpayer experience vastly improved during the 2023 filing season. The difference between the 2022 and 2023 filing seasons was like night and day.”

Taxpayer Advocate Service

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS. Its mission is to be the “voice of taxpayers” to ensure that every taxpayer is treated fairly and understands their rights. TAS efforts are based on four priorities:

- Help taxpayers with problems they can’t resolve with the IRS.

- Understand your issues as a taxpayer and assure you that we’re here to help you.

- Protect taxpayers’ rights.

- Recommend changes to Congress to help prevent future problems.

“What a Difference a Year Makes” – Positive Progress

Here are two specific examples of enhanced taxpayer services rendered by the IRS in 2023 as presented in the TAS 2024 Objectives Report to Congress:

Processing of original tax returns.

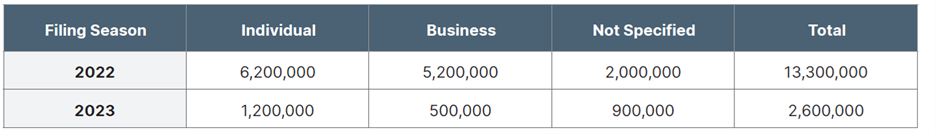

- For the week ending April 22, 2023, the IRS had 2.6 million unprocessed individual and business tax returns, compared to 13.3 million as of the same date in 2022, a reduction of 80%.

Telephone service.

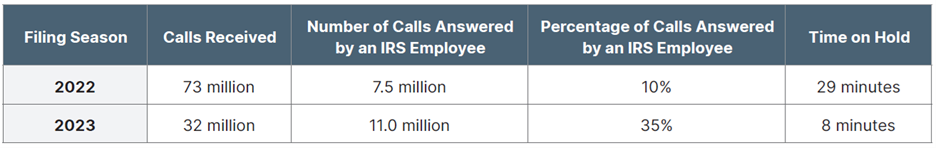

- In 2022, the IRS answered 10% of the 7.5 million calls it received, keeping each caller on hold for an average of 29 minutes. In 2023, the IRS answered 35% of the 32 million calls it received, keeping each caller on hold for an average of eight minutes.

Click Here for more details.

Fraud & Identity Theft – Effect on Processing Times

Business processing delays are largely attributed to Employee Retention Credit (ERC) claims. The ERC is a refundable tax credit authorized by Congress to encourage employers to retain employees during the C-19 pandemic. The IRS has received a significant number of fraudulent claims … serious enough to warrant inclusion of the offenses on its “Dirty Dozen” list of tax scams.

The result for processing times is impacted by submission of amended returns by businesses. At the end of May, the backlog of ERC claims was estimated at 800,000 with more forms arriving daily.

“The influx of fraudulent claims has put the IRS between a rock and a hard place,” Collins wrote. “If the IRS pays out claims quickly without taking the time to review them individually, it will be making some payments to individuals potentially engaged in fraud. If it takes the time to review claims individually, legitimate businesses who need the funds Congress authorized to help them stay afloat may not receive them in time.”

Click here for more info on fraudulent ERC advisors.

Victims of identity theft have suffered from particularly long and frustrating delays. The average cycle time for Identity Theft Victim Assistance cases closed in April 2023 was 436 days … nearly 15 months … about three months longer than the 362-day cycle time for cases closed in April 2022.

Conclusions & Recommendations

“Despite these areas of relative weakness,” the report says, “the big picture shows taxpayers had a much easier time reaching the IRS this filing season, reducing the need for repeat calls and lengthy wait times – a welcome relief for millions of taxpayers.”

Notwithstanding these improvements, the report confirms the IRS is still behind in processing amended tax returns and taxpayer correspondence. Typically, employees in the IRS’s Accounts Management function perform two roles – they answer telephone calls, and they process taxpayer correspondence, amended returns, and other cases.

The report says the IRS was much more effective in answering taxpayer calls this year, “but [that] could only be accomplished by prioritizing the phones over other IRS operations, and it resulted in greater delays in the processing of paper correspondence.”

Collins wrote … “to achieve and sustain transformational improvement over the longer term, the IRS must focus like a laser beam on IT”. In the report, Collins’ office urged the IRS to focus its efforts on modernizing outdated technology meant to improve the taxpayer experience. That is possible because of the additional $20 billion in funding that the IRS is budgeted to receive.

Collins’ IT to-do list includes:

- Robust online accounts for taxpayers that are comparable to accounts provided by banks and other financial institutions;

- Allowing all taxpayers to e-file tax returns;

- Allowing taxpayers to receive and submit responses to information requests electronically in all interactions with the IRS; and

- Replacing its 60 discrete case management systems that have limited ability to communicate with each other with an integrated, Service-wide system.

“But with adequate funding, leadership prioritization, and appropriate oversight from Congress, I believe the IRS will make considerable progress in the next three to five years in helping taxpayers comply with their tax obligations as painlessly as possible,” Collins wrote.

The above presentation is meant as an overview only.

Give us a call and we’ll quickly help you with questions.