Some May Apply to Your Retirement Plan

Tax Advantaged Retirement Plans

Congress enacted regulations that provide significant tax advantages to American taxpayers that participate in one or more qualified retirement plans. The term qualified retirement plans refers to the following:

- Qualified employer sponsored plans such as a 401(k)

- Qualified employee 403(a) annuity

- Tax-sheltered 403 (b) for employees of public schools or tax-exempt entities

- Individual Retirement Accounts (IRA)

You may currently participate in a tax advantaged retirement plan or consider doing so. Your payoff is added financial incentive to enhance your retirement nest-egg through immediate tax savings and long-term tax-deferred investment income such as capital gains and dividends.

At retirement, qualified plan distributions are subject to income tax … perhaps at a time when you are in a lower tax bracket. That said, there are tax penalties for “early” or “premature” distributions … generally defined as qualified plan withdrawals prior to age 59½.

The legislative intent of qualified plans is to encourage taxpayers to set aside and invest money for the long-term, namely to provide a financial cushion at retirement. To discourage the use of qualified plan funds for purposes other than normal retirement, the law imposes a tax penalty on early distributions. Result … early withdrawals must be reported as gross income, plus a 10% penalty tax of that amount is due and payable.

Now Back to Rules … and Exceptions to Rules

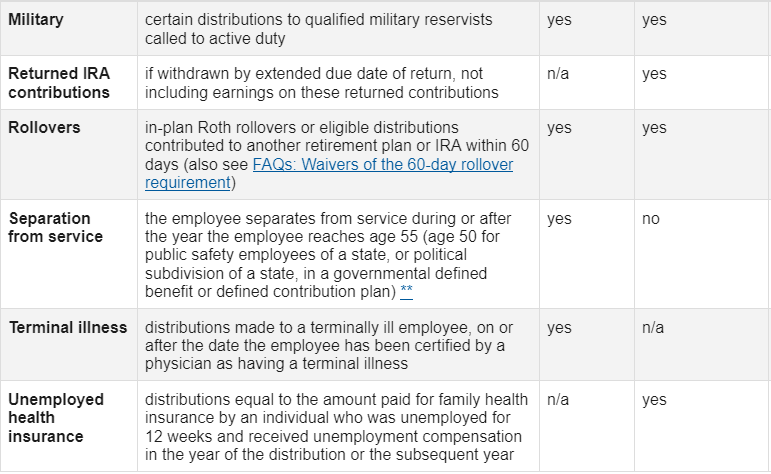

The SECURE 2.0 Act, passed as part of an omnibus spending bill in December 2022, added new exceptions to the 10% federal income tax penalty for early withdrawals from tax-advantaged retirement accounts. Withdrawals covered by these exceptions can be repaid within three years to an eligible retirement plan. If repayment is made after the year of the distribution, an amended return must be filed to obtain a refund of any taxes paid.

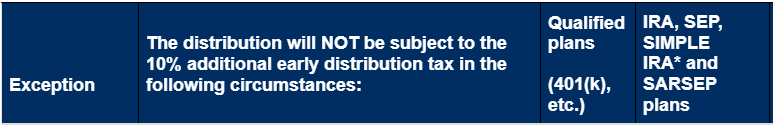

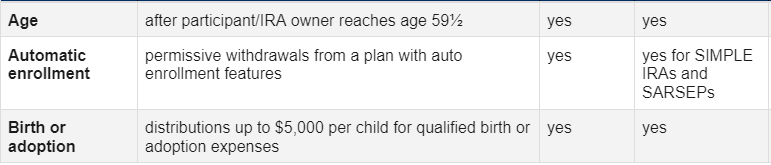

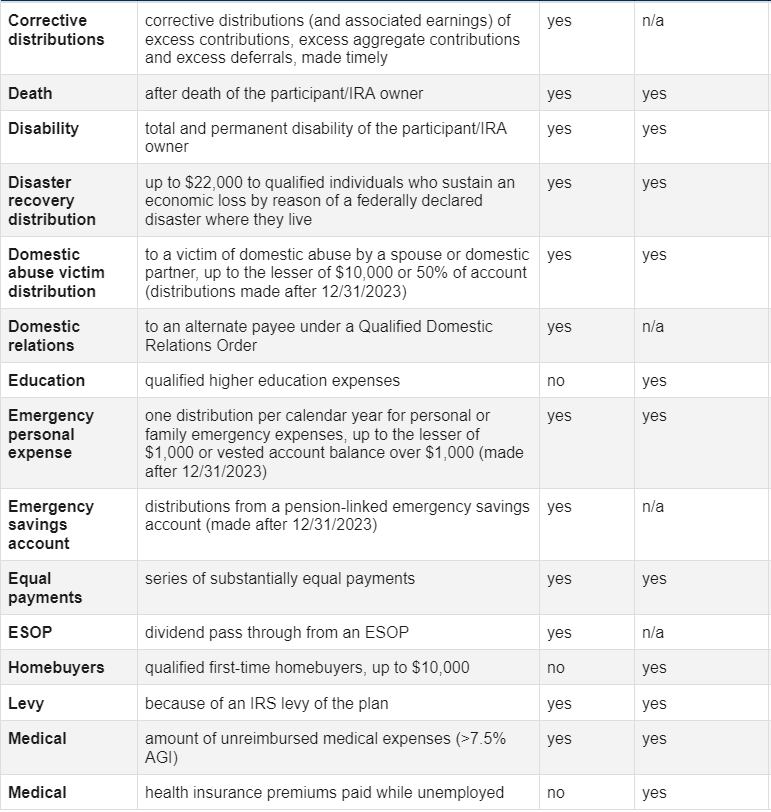

Please see the following chart that outlines the exceptions and identifies which qualified plans are eligible.

EXCEPTIONS TO THE 10% ADDITIONAL TAX

The foregoing is meant as an overview only. Give us a call and we’ll help you

determine next steps regarding any problems you face with the IRS.