401(k) and IRA Contribution Limits Increased

Contribution limits for 401(k)s, 403(b)s, 457(b)s, IRAs, Roth IRAs, HSAs, FSAs, SIMPLE IRAs, and SEP-IRAs are all indexed to inflation. While the contribution limits don’t go up every year, you will generally see an increased contribution every year or two.

The inflation rate is now running at a 40-year high. That triggered the IRS to announce significant jumps in allowed contributions for tax year 2023. More specifically:

- Taxpayers under age 50 can contribute to their 401(k), 403(b), most 457 and the federal government’s Thrift Savings Plan accounts … increases to $22,500 for 2023 … a $2,000 bump over 2022 limits.

- Notably, taxpayers 50 and older win a further concession … a $3,000 boost to $30,000 annually. That number includes a $7,500 so-called catch-up contribution, up from $6,500 in 2022.

Participants in qualifying plans can reduce their 2023 tax bill by

increasing the amount they contribute pre-tax to retirement accounts.

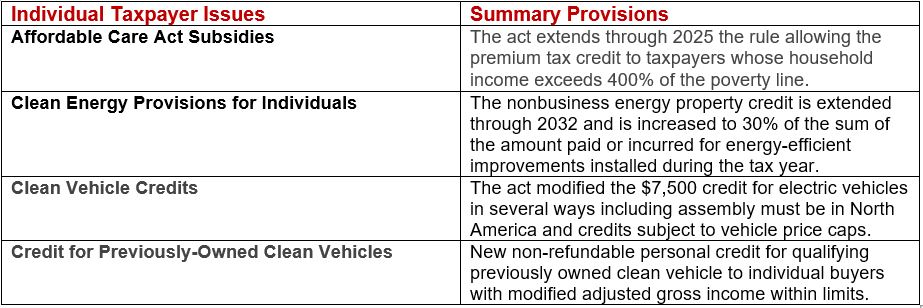

Here’s a summary of the key provisions of the changes for 2023.

401(k) Plans – Annual Contribution Limits

- Employees under age 50 – $22,500, up $2,000 from 2022.

- Employees 50 and older – $30,000 (Includes $7,500 catch-up contribution, up from $6,500)

- If the Plan permits, additional after-tax employee contributions may be made to top-out the total employer/employee contribution limits – employees under age 50, $66,000; 50 and older, $73,500.

IRA – Annual Contribution Limits

- Increased to $6,500 from $6,000

- Participants 50 and older can make an additional $1,000 catch-up contribution.

Note: You can’t make a tax-deductible contribution to an IRA unless you have no workplace retirement plan, or your income is below certain limits. For 2023, the deduction will phase out for single taxpayers earning between $73,000 and $83,000 (up from $68,000 to $78,000) … and for married couples filing jointly earning $116,000 to $136,000 (up from $109,000 and $129,000 respectively).

If your spouse is covered by a workplace plan and you’re not, your deduction for an IRA phases out between $218,000 and $228,000 in 2023, up from $204,000 to $214,000 in 2022.

Roth IRA – Annual Contribution Limits

- Increased to $6,500 from $6,000

- Participants 50 and older can make an additional $3,000 catch-up contribution.

Note: The income phase-out for contributions to a Roth IRA for singles and heads of household will be $138,000 to $153,000 respectively in 2023, up from $129,000 to $144,000. For married couples filing jointly, the phase-out range will be $218,000 to $228,000, up from $204,000 to $214,000 this year.

Simple IRA Accounts – Annual Contribution Limits

- Increased to $15,500, up from $14,000

- If the Plan permits, employee participants 50 and older can make an additional $3,500 catch-up contribution, up from $3,000 in 2022.

- Employee participation in other employer plans is limited to a combined annual contribution of $22,500.

Saver’s Credit

Low and moderate-income workers may add to their retirement fund value via federal tax credits that deliver a 100% reduction in the taxpayer’s tax-bill. Eligible workers may enjoy a tax credit in a range of 10% to 50% of contributions made to an IRA or employer sponsored retirement plan.

Note: The credit gradually reduces and phases out as a taxpayer’s income rises. In 2023, the credit will phase out at $73,000 for married couples filing joint tax returns (up from $68,000); $36,500 for singles and couples filing separately (up from $34,000); and $54,750 for heads of household (up from $51,000).

SEP IRAs – Annual Contribution Limits

(Self-employed & Small Business Owners)

- Increased to $66,000 from 2022 limit of $61,000

- Self-employed persons may contribute up to 20% of earnings up to $330,000, up from $305,000.

For more on how the above applies to your specific circumstances,

be sure to give Pearson & Co a call or drop an email. We’ll respond immediately.