WHAT’S IN A NAME?

Lots … When It Comes to Working from Home Tax Breaks

Working from home (WFH) now has become a dominant reality for many American workers. You may be one of the approximately 45 million persons working from home full-time … or know a relative, friend or professional colleague who are among the 42 percent of the U.S. labor force doing so.

The WFH paradigm was triggered in response to the months-long health and economic challenges of COVID-19. Many experts, perhaps even most, agree that the WFH economy will prevail long after the coronavirus pandemic that spawned it is conquered.

Of course, this new phenomenon will produce both challenges and positive payoffs for WFH Americans. Work-life balance, finances and family issues will all be affected either positively or less-so in varying degrees.

In this article, we’ll focus on a frequent tax-related question asked by those working from home.

“What tax-breaks do I get for use of home floor space and added work-related expenses?”

The answer differs for those who the IRS deems to be an employee vs. an independent contractor. The former will not enjoy tax relief … while self-employed individuals may deduct certain business-related expenses. What follows is a rundown on how each worker classification may fare.

Who Does the IRS Consider to Be an Employee?

The simple answer is … if you receive a W-2 form for your work, you are an employee. Tax law revisions in 2018 prevents employees from deducting job-related expenses that are not reimbursed by their employer. And that is the case even when mandated by your employer to do so under current efforts to fight the spread of coronavirus.

When You Are Self-Employed/Independent Contractor

Self-employed workers, often referred to as independent contractors, may deduct allowable business-related costs. To do so requires that detailed records are maintained and itemized on your tax return.

You may qualify for one or more of the 10 deductions summarized below.

Note: Be sure to give us a call regarding how any of these or others may affect your unique circumstances.

Home Office

Your guiding principle to determine deductions for your home office is based on the percentage of space in your home exclusively devoted to business use. So, if you use a whole room or part of a room for conducting your business, you need to figure out the percentage of your home exclusively devoted to your business activities.

Note: Be precise. For example, if you only use one corner of your dining room table for business use … the total dining room floor space will not qualify.

You may then deduct the qualifying percentage for each of the following:

- Rent or interest on your home mortgage

- Utilities

- Homeowners insurance

- Property taxes

Additionally, the following will be considered as eligible deductions:

- Office Supplies

Essential items to your business such as printer paper and ink cartridges, desk and filing cabinet likely will qualify as deductible.

- Equipment

Computer, printers and equipment uniquely essential for your business plus repairs are deductible. Likewise, the cost of a smartphone you use solely for business and related expenses qualify as write-offs.

- Software

When used strictly for your business, any software you purchase or pay for monthly qualifies.

- Travel Costs

Travel expenses you incur to visit a client or attend a conference are deductible. That may include mileage, airfare, lodging, parking and other travel-related costs paid by you.

- Meals and Entertainment

Make sure that your costs are all directly related to business. Fifty percent of qualified expenses may then be deductible.

- Training and Education

Professional education expenses necessary to run or grow your business will qualify.

- Marketing and Advertising

Expenses to attend trade-shows, printed promotional items, website expenses, business cards and other marketing and advertising costs are deductible.

- Professional Services

You will likely incur expenses for outside help or advice. Your CPA, attorney, IT contractor and others will all qualify as fee-for-service deductions

- Health Insurance

If you meet the following criteria, you may deduct 100% of your health insurance premiums for yourself, your spouse and dependents:

- Your business is claiming a profit for the tax year, and

- you (and your spouse and dependents) were not eligible for coverage from an employer or under your spouse’s plan during the months you’re claiming.

.

Again, the above 10 items are meant only as a summary of deductions you may claim as a self-employed individual or independent contractor. There may be others that qualify, so it’s wise to keep track of expenses such as bank charges, shipping costs, post office box fees and reasonable costs for holiday gifts for your best clients.

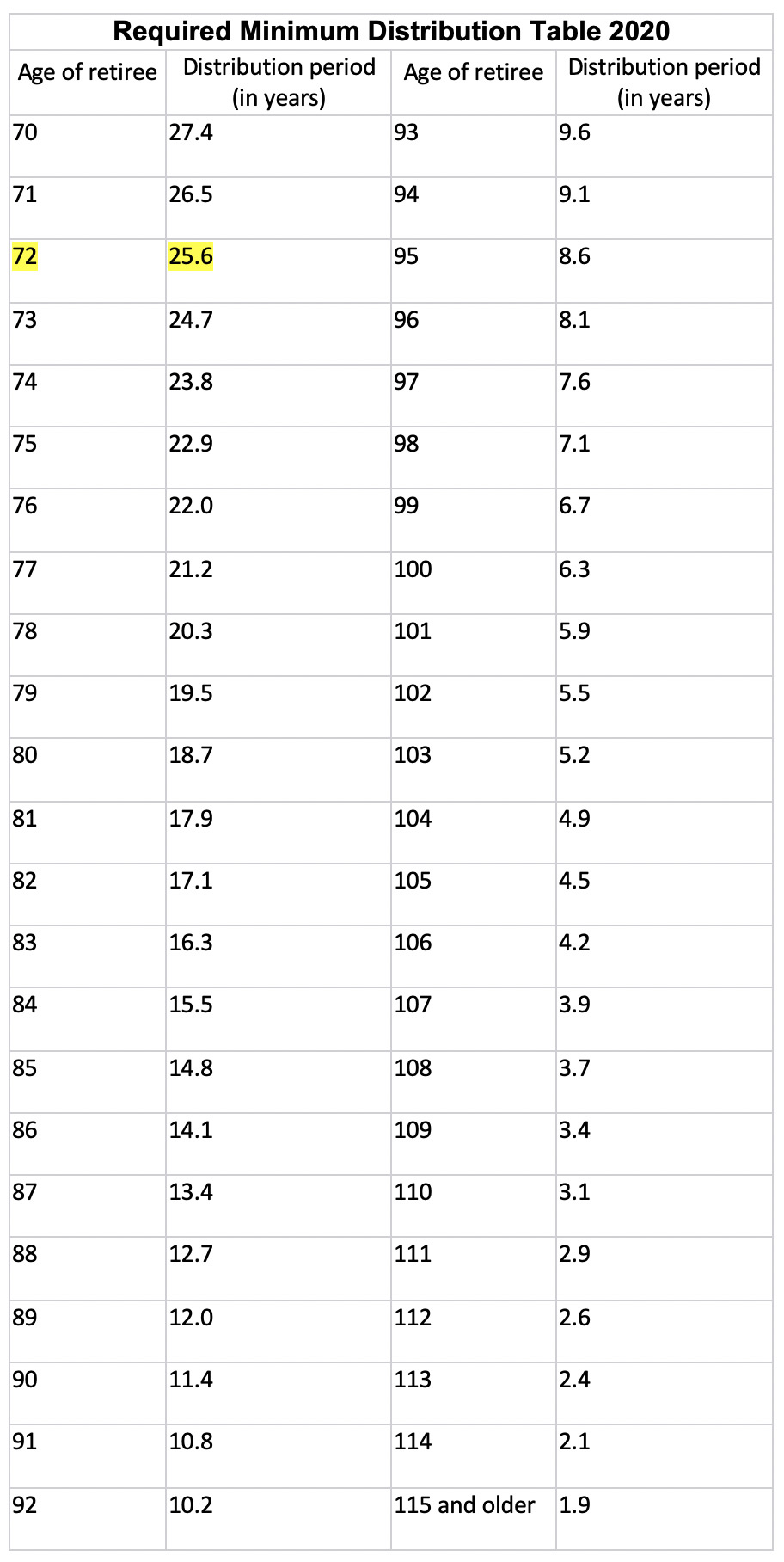

Earlier this year, we reported that President Trump signed the SECURE Act into law raising the Required Minimum Distribution (RMD) age to 72 from 70½ . That proved to be a boon for taxpayers who can afford to delay IRA withdrawals. Delaying receipt of the RMD until age 72 significantly reduced taxable income for many taxpayers. Be sure to

Earlier this year, we reported that President Trump signed the SECURE Act into law raising the Required Minimum Distribution (RMD) age to 72 from 70½ . That proved to be a boon for taxpayers who can afford to delay IRA withdrawals. Delaying receipt of the RMD until age 72 significantly reduced taxable income for many taxpayers. Be sure to

Business owners … you may qualify for one or more of three new tax credits announced and launched by the Treasury Department and the Internal Revenue Service.

Business owners … you may qualify for one or more of three new tax credits announced and launched by the Treasury Department and the Internal Revenue Service.