YOUR LIFE CYCLE … AND THE TAX CUTS & JOBS ACT (TCJA)

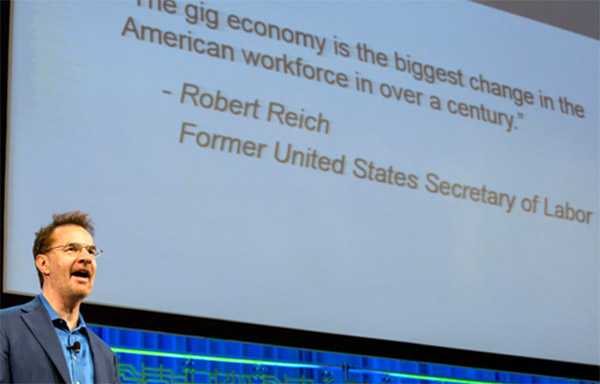

The TCJA Affects Your Tax Planning Regardless of Your Stage of Life

While there is every likelihood that there will be continued guidance from the IRS or legislators, here’s how we see the TCJA as it affects various stages in life for individual taxpayers. Keep in mind that almost all these provisions expire after 2025.

Life Events and the TCJA

Married adults now enjoy relief from the so-called “marriage penalty”. That means that their tax return filed jointly will more closely parallel that of two people filing as single

Personal and dependent exemptions are eliminated. In place of personal exemptions, TCJA essentially doubled the standard deduction. Likewise, in place of dependent exemptions, TCJA doubled the per child tax credit. Additionally, higher income families enjoy substantially increased income thresholds that trigger a phase-out of the credit yielding more tax savings.

Tax-advantaged education plans, 529 plans, now permit up to $10,000 may be used to pay for primary and secondary school … and enjoy tax-free withdrawal of that amount by parents and grandparents. Given the escalating costs of higher education, the tax-deferred feature of funds in 529 plans continues to be attractive and motivating to retain funds in the plan for as long as possible.

Taxpayers taking new mortgages are limited to interest deductions on the first $750,000 of loan principal and may no longer deduct interest for home equity debt … unless the loan is used to purchase, build or substantially renovate your home.

Itemized deductions for property taxes and state and local income or sales taxes now capped at $10,000.

Alternative Minimum Tax (AMT) exemption levels are increased and the income threshold at which the AMT exemption phases out is elevated. These moves will significantly reduce the number of tax payers subject to the AMT.

Job change expenses such as preparation of resumés, travel and other work-related costs are no longer permitted as an itemized deduction.

Moving expenses are eliminated as a deduction, other than for active-duty military under orders to relocate. The impact for employers is that reimbursing employees for moving expenses is no longer tax deductible.

Investment gains i.e., qualified dividends and long-term capital gains taxes, remain unchanged. However, of note is that the dollar amount breakpoint at which the rates apply has increased offering important tax savings to investors.

Taxpayers who support their elderly parents and choose to itemize may deduct out-of-pocket medical expenses at an increase from 7.5 percent to 10 percent in 2019.

The annual contribution to Achieving a Better Life Experience (ABLE) accounts is increased and may be used to claim the retirement saver’s credit as well. Additionally, funds in 529 plans may be rolled over to ABLE accounts to further benefit disabled individuals.

Couples divorcing after 2018 will find that alimony is no longer deductible, and payments to the recipient are no longer taxable as income.

Summary

Of course, the above, and more, is subject to interpretation and additional guidance by the IRS and federal legislators. So, here’s a suggestion if you have questions as to how the TCJA affects you and your tax planning.

A time-saving and less stressful approach is to give us a call or drop an email to schedule a time to review the specifics of your unique situation and develop an optimum tax strategy to benefit both you and your family.

Particularly at this time of year, you are likely to be solicited for contributions from charities and professional fundraisers working on behalf of charities. Your contact may be by phone, face-to-face, email or the internet … including social networking sites you may frequent.

Particularly at this time of year, you are likely to be solicited for contributions from charities and professional fundraisers working on behalf of charities. Your contact may be by phone, face-to-face, email or the internet … including social networking sites you may frequent.

Note: Most individual changes are effective January 1, 2018 and will expire at the end of 2025. Unless Congress passes another law prior to then, the old tax code provisions will be reinstated.

Note: Most individual changes are effective January 1, 2018 and will expire at the end of 2025. Unless Congress passes another law prior to then, the old tax code provisions will be reinstated.