THE EVER-EVOLVING FORM 1040

Hopes for a Postcard to File Your Taxes … Dashed Once Again!

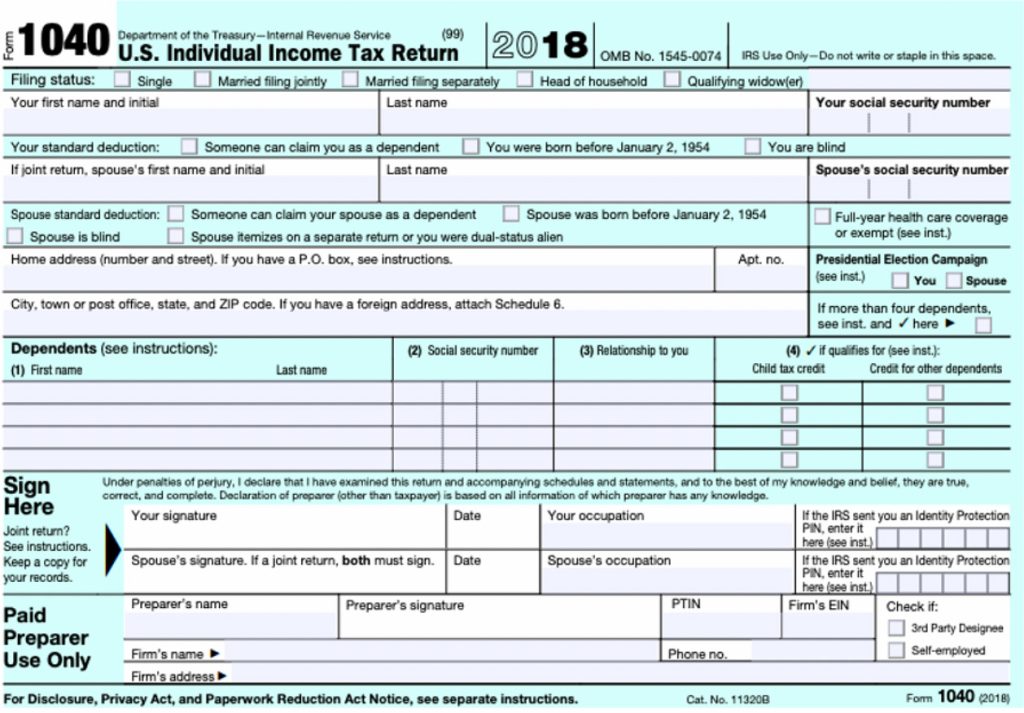

Earlier this year, the IRS heralded the introduction of a new and improved tax Form 1040. You’ve heard that the new tax law provides for a “postcard-sized” tax return. The intent was to simplify filing Form 1040 for the 2018 tax year and presumably beyond. Like most of us, you immediately came up with a postcard-like image.

Well as it turns out, the IRS vision of a postcard-sized 1040 came out like this.

Now Pay Attention! There’s a side 2 as well!

But wait, there’s more to the story. Six new schedules were introduced relating to such things as additional sources of income and qualifying for tax credits.

Assuming your tax situation was super-simple, your responsibility was to file the base postcard return. However, the reality is that you most likely faced the necessity to also file one or more of the new schedules.

Here’s the IRS matrix summary to help you know which new schedules may apply.

OK. So much for simplicity.

Now comes the latest 1040 news from the IRS … the “postcard-size” Form 1040 has been officially scrapped. The IRS has announced abandoning its earlier effort to revamp the latest form and working on a new version that more closely resembles the traditional 1040 … remember 2017.

In large part, this turn of events is a direct result of objections from the tax preparation community that viewed the revised “work-in-process” prototype as being inefficient and burdensome.

In the words of the IRS, “We generally do not release drafts of forms until we believe we have incorporated all changes. However, in this case we anticipate it is likely that this draft will change at least slightly before being released as final. Whether we make changes to this draft or not, we will post a new draft later this summer with our standard coversheet (this page) indicating we do not expect that draft of the form to change.”

There are numerous changes in the draft version as it continues to evolve. This is not the place to enumerate the differences as the final version has not been released … although expected in November of this year. In its current form, the new 1040 has one more line than its predecessor … 24 vs. 23 and sports being 1.5 inches longer than the 2018 version.

Additionally, the Schedules 1-6 referenced above have been reduced to just three … Schedules 4, 5, and 6, which dealt with taxes on retirement plans, refundable credits and foreign addresses will no longer be in use Depending on content in the remaining three, a sigh of relief is in order.

Taxpayers Age 65 and Older … A 1040 Built for You

In July of this year, the IRS released a draft form of the 1040-SR, U.S. Tax Return for Seniors. Some of the design elements include:

- Highlights retirement income streams and other tax benefits for older taxpayers.

- Based on the regular 1040 and uses same schedules, instructions and attachments.

- Larger fonts to make the text easier to read.

- A standard deduction chart is featured for seniors to take advantage of the higher standard deduction.

To learn more about the debut of this form tailored for taxpayers 65 and older … Click Here.

How Will The New Form Affect You? Perhaps Not at All.

You are probably among the majority of American taxpayers who won’t file a paper tax Form 1040. Nearly 90% of taxpayers are expected to use a tax preparer or file electronically … more than 131 million people e-filed their returns in 2019.

If you intend your tax filing for 2019 to be a DIY project, be sure to reconsider and seek the services of a tax preparation professional. You’ll benefit from enhanced peace of mind and know that your tax bite, or refund, is accurate and to your maximum benefit based on your unique circumstances.