SECURE ACT BUMPS RMD AGE TO 72!

A Boon for Taxpayers Who Can Afford to Delay IRA Withdrawals

Required Minimum Distributions (RMDs) are mandatory for Americans who are participants in Individual Retirement Accounts (IRAs) or participate in a 401K plan. In this article we’ll lump all under the heading of retirement accounts.

Required Minimum Distributions (RMDs) are mandatory for Americans who are participants in Individual Retirement Accounts (IRAs) or participate in a 401K plan. In this article we’ll lump all under the heading of retirement accounts.

Since inception of the above plans, RMDs were the rule beginning at age 70½. With a stroke of his pen, President Trump signed the SECURE Act into law raising the RMD age to 72. This revision reflects that Americans are living and working longer. Notably, since the original law was enacted, life expectancy has increased more than 2 percent (1.6 years) for all Americans and more than 8 percent for those over age 65.

So, that means beginning January 1, 2020, money from the above retirement accounts must start flowing to you in specific, minimum amounts no later than April 1 following the year you reach age 72. Other than Roth IRAs, RMD withdrawals apply to all other individual retirement accounts … IRA, Simple IRA or SEP IRA as well as 401K plans.

Note: Roth IRAs are not subject to mandatory withdrawals until after the death of the owner.

Estimates are that only about 20 percent of retirees take no more than the minimum RMD. So, the change to the rules will have little effect on the remaining 80 percent who withdraw more than the IRS requires.

The RMD changes are a boon to most taxpayers who can afford to delay taking money out.

Here’s an example of the tax-saving difference the new RMD limit may deliver to a taxpayer who will be 70½ this year and having a retirement account valued at $100,000. Under the old rules, that person would be required to take a minimum IRA withdrawal of $3,650 in tax year 2020. In contrast, under the SECURE Act, the RMD will be $3,906 at age 72.

Delaying receipt of the RMD until age 72 reduces the taxpayer’s taxable income by $7,300.

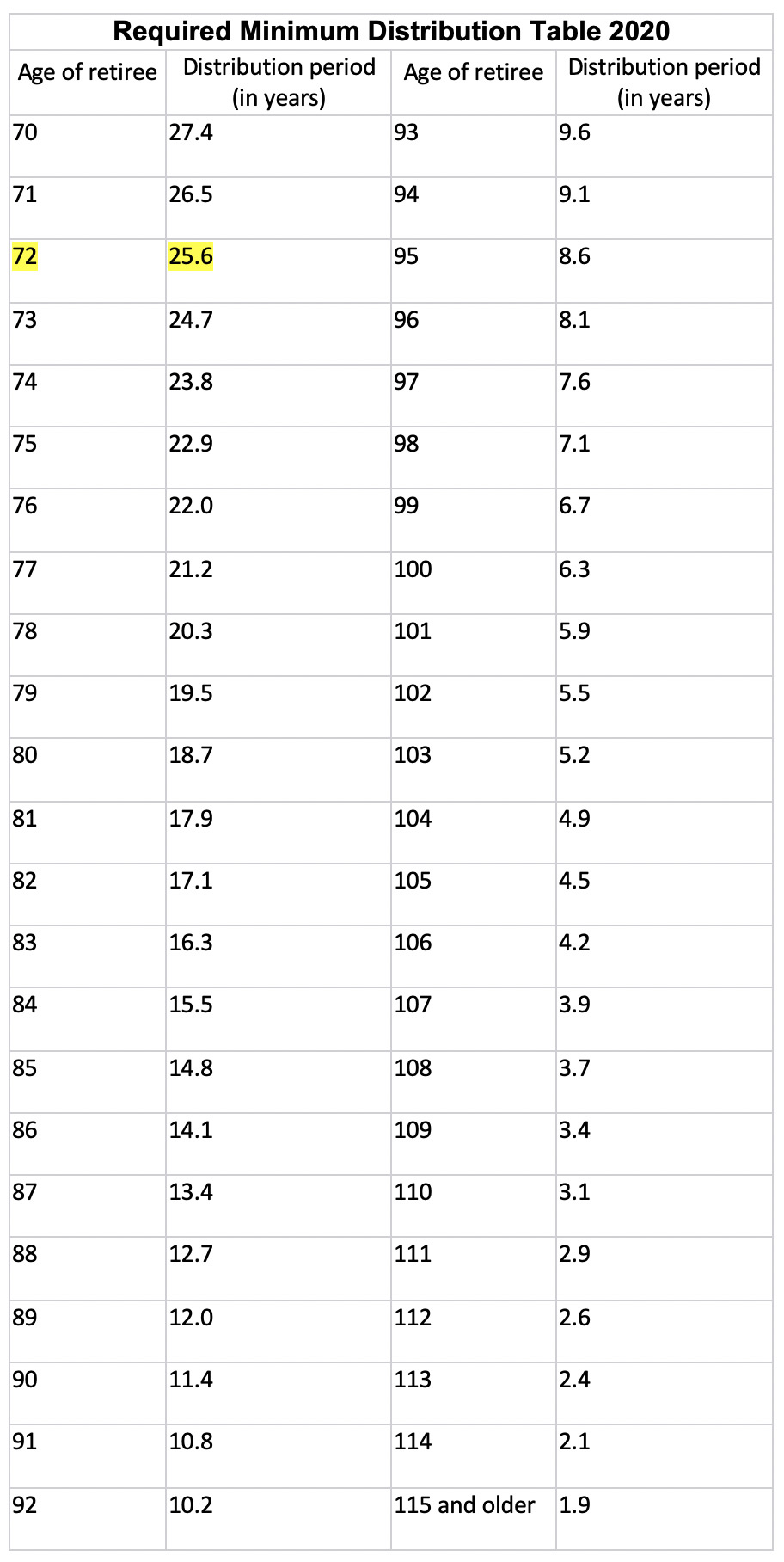

The distribution amount will change from year to year based on accepted IRS tables that model anticipated life expectancy. Since life expectancy estimates diminish with age, annual RMD will vary as well. The exact distribution amount changes from year to year. It is calculated by dividing an account’s year-end value by the distribution period determined by the IRS.

The table shown below is the Uniform Lifetime Table, the most commonly used of three life-expectancy charts that help retirement account holders figure mandatory distributions. The other tables are for beneficiaries of retirement funds and account holders who have much younger spouses.

So, in keeping with the above calculations, assume our retiree is age 72 with a retirement account valued at $100,000. To calculate the year’s RMD amount, look at the age of the retiree on Dec. 31 (72) and note the corresponding distribution period (25.6). Divide the value of the retirement account by the distribution period to determine the RMD for that tax year … $100,000 divided by 25.6 = $3,906.

Note: Make sure you do this for all traditional IRAs or 401 K accounts you have in your name. Once you add up all of the RMDs for each of your accounts, you can withdraw that total amount from one or more of your retirement accounts. You don’t have to take your RMD from each account as long as the total you withdraw satisfies your RMD responsibility. Consider withdrawing from smaller balance accounts and close them out to simplify and consolidate your retirement accounts.

Why is a Minimum Distribution Required?

The good news is that you enjoyed years of tax deductions and (hopefully) tax deferred growth in your retirement account. So, it’s your money … why can’t you decide how much and when to take it out … or just leave it sit? The answer is the tax-man will get his due.

You paid no taxes on your deductible retirement plan contributions. And you paid no taxes on any incremental growth on your investments during the years accumulating your nest egg. Therefore, the IRS wants its just due when you withdraw funds in your retirement. That said, chances are your post-retirement tax bracket is lower than during your prime earning years, so you’ll likely keep more money than if you had not initiated your retirement account.

Similarly, if you were permitted to leave all your money in your retirement account, it would eventually become eligible to be passed on as inheritance and not trigger a taxable event. Your RMD compels you to take out at least a minimum amount which is added to your gross income and potentially subject to tax.

3 Frequently Asked Questions

There are three questions that are commonly asked and may be on your mind as well. It’s likely you will have others that we’d like to help you with … just give us a call or drop an email … we’ll respond promptly.

- Do you need to take your entire RMD all at one time?

No. Frequency of withdrawals is not an issue. The important thing is that, in the aggregate, all your withdrawals add up to your RMD in the year required. - Should you appoint a named beneficiary for each of your retirement accounts?

Yes. By so doing you will avoid your account balance(s) being included in your estate in the event of your death. - Are there consequences if I don’t withdraw my RMD as required?

Yes. You may be subject to a 50 percent excise tax on the amount not distributed.

Other Considerations

The foregoing is not meant as a comprehensive recount of the RMD requirements. There are other considerations that may apply in your specific circumstances. Some issues may include:

- Inherited retirement accounts and RMD after account owner dies

- RMD based on Joint Life & Last Survivor Expectancy Table if your spouse is more than 10 years younger than you and is sole beneficiary

If any of the foregoing seems unclear as to how it applies to your specific circumstances, please keep in mind that Pearson & Co. will help. Give us a call or drop an email. We’ll respond immediately.