Learn How Your Tax Bill May Be Affected

The old saying that the only thing constant is change … and that certainly applies annually to the U.S. tax code. That said, it’s no surprise that 2022 taxes will differ from last tax year. Here’s a rundown on how those revisions may affect your taxes come next filing season.

The old saying that the only thing constant is change … and that certainly applies annually to the U.S. tax code. That said, it’s no surprise that 2022 taxes will differ from last tax year. Here’s a rundown on how those revisions may affect your taxes come next filing season.

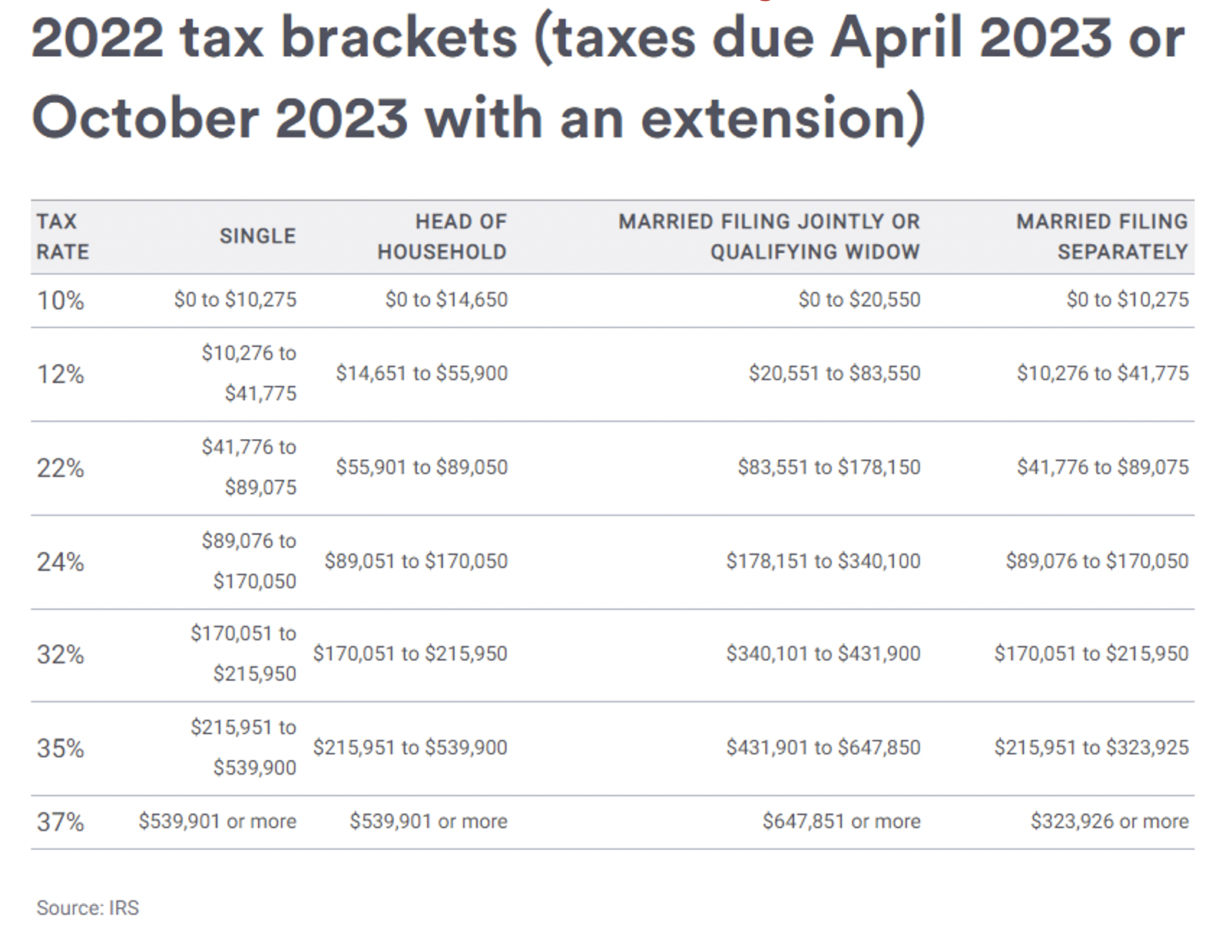

1. Tax Brackets Increase

Your tax bracket triggers the calculation of your tax bill. Each year, the IRS adjusts these brackets to keep pace with inflation. The objective is to prevent “bracket creep” … where the rate of inflation drives a tax payer into a higher tax bracket.

Note: With higher-than-expected inflation, some taxpayers may pay more in 2022, even with the adjustments referred to above.

The table below shows federal tax brackets for 2022. The “Tax Rate” column refers to your Marginal Tax Rate … how much you would pay on one more dollar of taxable income. For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If you had $41,000 of taxable income, however, most of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Rule of Thumb: About a 3% inflation-adjusted increase over 2021.

2. Standard Deduction Increase

You will likely choose the standard deduction which doubled with the passing of the Tax Cuts and Jobs Act to compensate for the loss of personal exemptions. The 2022 standard deductions for all filing statuses are as follows:

Single: $12,950 (up from $12,550 in 2021)

Head of Household: $19,400 (up from $18,800)

Married Filing Jointly: $25,900 (up from $25,100)

Married Filing Separately: $12,950 (up from $12,550.

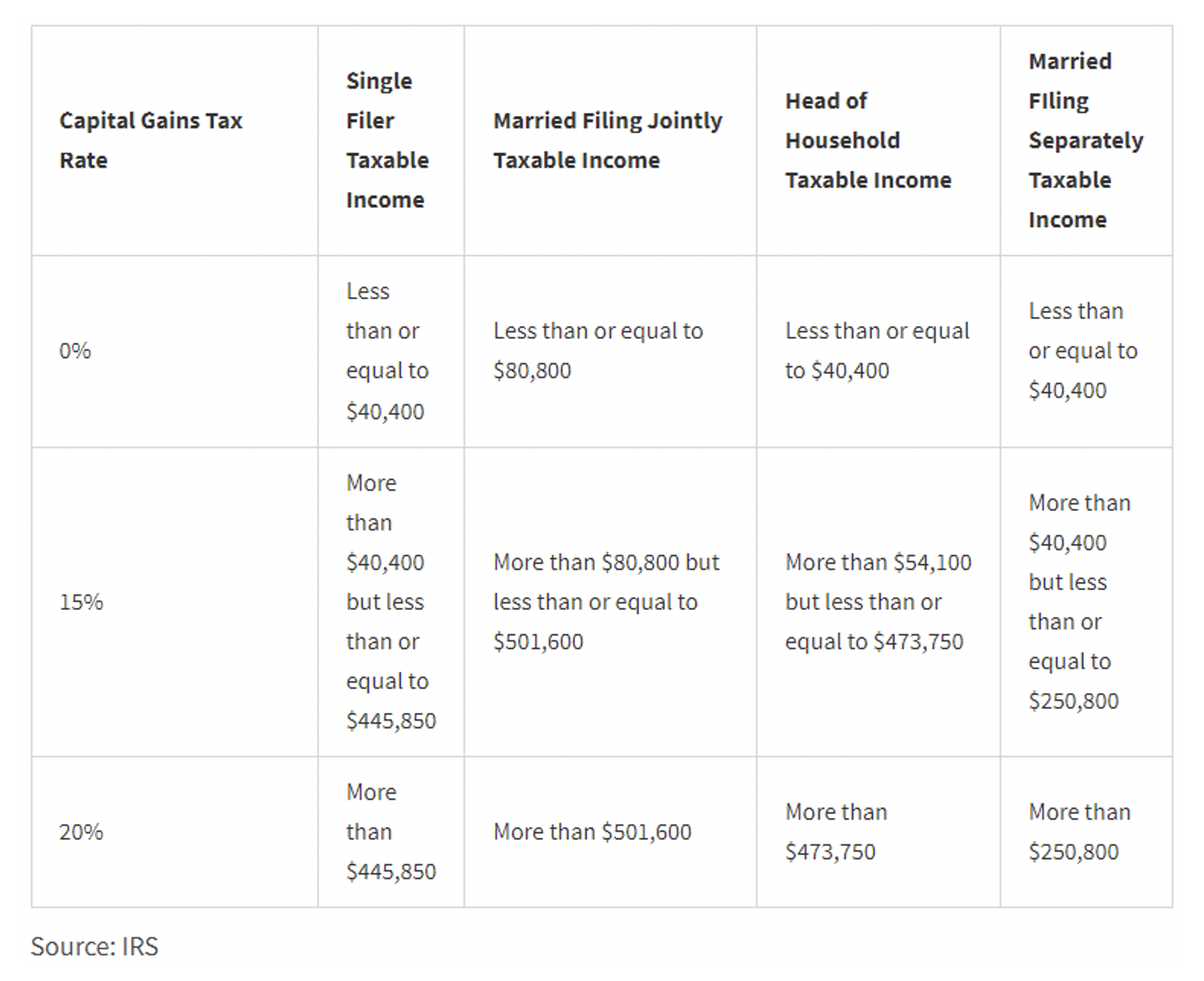

3. Capital Gains Tax Increase

Capital gains taxes are assessed on profits realized from the sale of an asset. Short-term gains are taxed as ordinary income. Long-term gains are those on assets you’ve held for at least a year. The long-term income thresholds have been increased for 2022 as illustrated in the following table.

4. Earned Income Tax credit

The earned income tax credit (EIC or EITC) is a refundable tax credit for low and moderate-income workers. The amount depends on income and the number of children. Note: People without kids can qualify. For 2022, the earned income credit range will be $560 to $6,935, depending on income and the number of children … a reduction from the range in 2021.

5. Alternative Minimum Tax (AMT) Increase

The single taxpayer exemption for tax year 2022 increased to $75,900. That maximum exemption begins to phase out when taxpayer income reaches $539,900. The exemption for married couples filing jointly is $118,100 and begins to phase out at $1,079,800.

6. Estate Tax Exemption Limits and Gift Tax Limits Rise

The federal estate tax exemption rises to $12.06 million from $11.7 million in 2022. The gift tax annual exclusion … the amount you can give each person before you use up some of the estate tax exemption (or owe gift taxes) … increases to $16,000 from $15,000.

7. HSA Contribution Limits Increase

Health savings accounts let you save money in a special tax-advantaged account for future medical expenses. In 2022, the amount you can reserve increases to $3,650 for self-only coverage (up from $3,600 in 2021) and $7,300 for taxpayers with family coverage (up from $7,200).

8. Traditional IRA Income Restrictions Rise

Contribution limits for IRAs remain unchanged at $6,000 if you are under 50 years old and $7,000 if you are 50 or older.

There are changes for IRAs in 2022 for taxpayers covered by an employer-sponsored plan. If you’re covered by a retirement plan at work, use this table to determine if your modified AGI affects the amount of your deduction.

Note: Your modified AGI is the sum of your adjusted gross income (AGI), your tax-exempt interest income, and specific deductions added back. The IRS uses MAGI to establish whether you qualify for certain tax benefits.

9. Increased Income Limits for Contributions to a Roth IRA

Contributions to Roth IRAs are restricted to taxpayers with income that exceeds specific limits.

Single filers: For 2022, your maximum contribution is reduced when your modified adjusted gross income is $129,000 (up from $125,000 in 2021) and eliminated at $144,000 (up from $140,000).

Joint filers: Your maximum contribution is reduced when your modified adjusted gross income is $204,000 (up from $198,000) and eliminated at $214,000 (up from $208,000).

10. Employer-Sponsored Retirement Contribution Limits Increase

The contribution limit for elective deferrals to 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan increases to $20,500 for 2022. The total amount that can be contributed to a plan by you and your employer combined rises to $61,500 from $58,000 in 2021. However, the amount of the catch-up contribution for taxpayers aged 50 and older remains at $6,500.

11. Child Care Tax Credit

The provisions for this credit expired December 31, 2021, and not renewed for tax year 2022.

Have Immediate Questions or Concerns!

Pearson & Co stand ready to help as needed. A phone call or email is all it takes. We’ll respond promptly.