INDIVIDUAL TAXPAYERS

Be Sure to See If You Qualify for Three Tax Credits

Taxpayers!

You may qualify for one or more of three often overlooked tax credits that may put more money in your pocket.

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- American Opportunity Credit (AOC)

If you qualify, tax credits will reduce the amount of tax you will pay. Unlike a deduction, which reduces the amount of income subject to tax, a credit directly reduces the tax itself. Here’s a brief rundown on each to determine your qualifications and potential tax-savings payoffs.

Note: Even if you are not required to file a tax return, consider doing so. If you qualify, you must file a 2017 tax return to claim your tax credit. You may end up paying less federal tax, pay no tax or even get a tax refund.

Earned Income Tax Credit (EITC)

Note: Four of five eligible workers qualify – If not you, maybe someone you know.

Millions of taxpayers are likely missing out on this significant tax credit. That means larger refunds are being forfeited due to lack of awareness of this benefit.

If you know friends or loved ones who you think may have earned around $54,000 or less last year, you may do them a favor to learn about EITC eligibility and use the EITC Assistant to find out if they qualify.

Alternatively, we’ll be happy to help. Consider these potential benefits:

- Eligible families with three or more qualifying children could get a maximum credit of up to $6,318.

- People without children may receive an additional tax refund of $506.

- Some may qualify even if they owe no tax in 2017.

Here’s more detail from the Internal Revenue Service to determine your qualifications and potential tax-savings payoffs.

2017 EITC Income Limits, Maximum Credit Amounts and Tax Law Updates

Earned Income and AGI Limits

Earned income and adjusted gross income (AGI) must each be less than:

Investment Income Limit

Investment income must be $3,450 or less for the year.

Maximum Credit Amounts

The maximum amount of credit for Tax Year 2017 is:

- $6,318 with three or more qualifying children

- $5,616 with two qualifying children

- $3,400 with one qualifying child

- $510 with no qualifying children

A last word on qualifying taxpayers … you may qualify as a taxpayer with disabilities, parents of children with disabilities or a grandparent who works and are also raising grandchildren.

Certainly worth asking the question, “Do I qualify?” Give us a call. We will deliver your answer.

Child Tax Credit (CTC)

You may be eligible to claim a tax credit that will reduce your tax by as much as $1,000 per qualifying child. Additionally, if you do not qualify for the full amount, you may be able to take the refundable additional child tax credit. The basic criteria to determine a child’s qualifications are:

- Is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (for example, your grandchild, niece, or nephew);

- Was under age 17 at the end of 2017;

- Did not provide over half of his or her own support for 2017;

- Lived with you for more than half of 2017;

- Is claimed as a dependent on your return;

- Does not file a joint return for the year; and

- Was a U.S. citizen, a U.S. national, or a resident of the United States. If the child was adopted, see Adopted child.

Note: If you have at least one child that qualifies for the CTC, you may also be eligible for the Additional Child Tax Credit if you get less than the full amount of the CTC.

Clearly, this may be a complicated series of qualifications to decipher. If you even think you may qualify, give us a call to discuss and determine what you may expect in tax credits.

By law, the IRS is required to hold EITC and Additional Child Tax Credit refunds until mid-February — even the portion not associated with the EITC or ACTC. The IRS expects the earliest of these refunds to be available in taxpayer bank accounts or debit cards starting February 27, 2018, if these taxpayers choose direct deposit and there are no other issues with their tax return.

American Opportunity Credit (AOC)

You may be able to claim a credit of up to $2,500 for education expenses you paid for each student who qualifies for the AOC. The basic qualifying requirements are:

- The student is yourself, your spouse or a person claimed as a dependent on your return.

- You pay the education expenses for a student enrolled in qualified, higher education.

Forty percent of the American opportunity credit may be refundable. So if the refundable portion of your credit is more than your tax, the excess will be refunded to you.

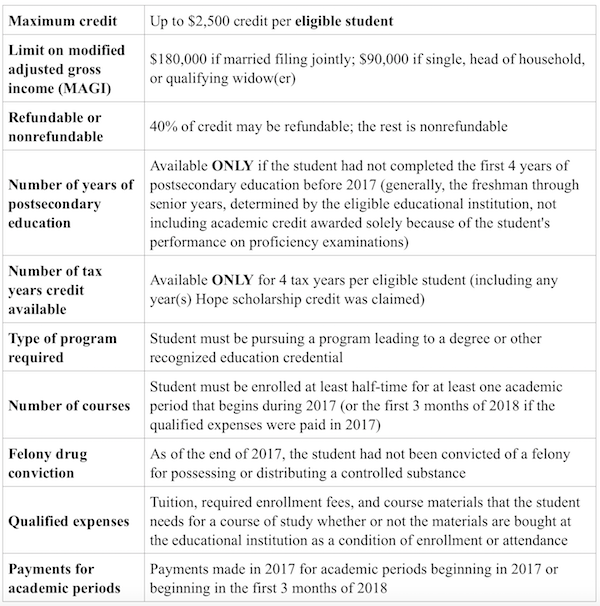

There are limitations on the amount of your income and the amount of your tax owed. Here’s an overview of those requirements and others.

Table 2-1.Overview of the American Opportunity Credit for 2017

Click Here for the IRS details. Better yet, give us a call and we’ll quickly help you determine if you qualify and for how much.

Summary

You may qualify for one or more of three often overlooked tax credits that may end up with you paying less federal tax, pay no tax or even get a tax refund. Millions of taxpayers are missing out on this significant tax credit. That means larger refunds are being forfeited due to lack of awareness of this benefit.

Even if you are not required to file a tax return, consider doing so. If you qualify, you must file a 2017 tax return to claim your tax credit.