SUPREME COURT RULING STUNS SMALL ONLINE BUSINESSES

SUPREME COURT RULING STUNS SMALL ONLINE BUSINESSES

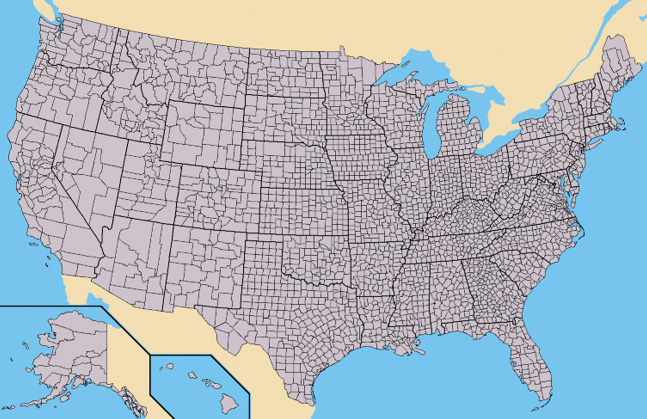

At Stake … Comply With Tax Laws of 50 States and 3,000+ Counties

To Collect and Remit Sales Taxes

In a decision earlier this year, the Supreme Court of the U.S. (SCOTUS) ruled that states may collect sales taxes on sales by businesses within the state … whether or not the business had a physical presence in the state. This overturned a 1992 SCOTUS ruling which limited states ability to collect sales taxes only from entities with a brick-and-mortar presence within its borders. The prior decision has now been declared “unsound and incorrect” by the high court.

Impacts of the latest ruling have been received as either an unprecedented economic burden or a long overdue and positive leveling of the playing field. Small businesses selling online subscribe to the former while larger companies and tax collecting jurisdictions applaud the decision. Let’s take a look at who loses, who wins and what role Congress may play as the repercussions of this ruling pan out.

Small Online Businesses

The real challenge for small online businesses is the complexity of compliance issue. Each state determines what products, goods or services are subject to sales tax. Additionally, there are county and local tax jurisdictions that may weigh in for their share as well. So small online businesses are faced with a myriad of designations of what’s taxable, by whom, and in what amount … without any uniform definition.

So from a practical standpoint, let’s consider a Virginia based business that sells online. Clearly, the responsibility for sales within the Commonwealth is to collect and remit taxes to appropriate tax collection entities. Depending on volume of sales, that may require a few hours or at most several days for an employee to perform this function as part of a larger job responsibility.

Now duplicate that function with clashing requirements by 50 states, 3,000+ counties and by some estimates potentially as many as 12,000 jurisdictions nationally … no longer a part-time activity. Perhaps a typical example is a small business paying $20 to $60 quarterly to each of dozens/hundreds of jurisdictions.

So businesses, especially small businesses, operate on the same basis as individuals … finite financial resources to be deployed in the most advantageous way to maintain and promote the value of the business to all stakeholders – customers, owners and employees. Cost to employ compliance personnel restricts or eliminates valuable assets that may otherwise be directed to job creation, capital formation and return on investment. That means added cost to the detriment of increased investment in economic growth with a “trickle-up” loss to the national welfare.

When you consider the sheer numbers of tax jurisdictions that now must be served by small online businesses, with no uniformity of compliance requirements, recognize another likely event … audits by out-of-state jurisdictions. What’s a small business to do when faced with a claim? Respond with legal representation to a demand letter … at what cost … or take the easy way out and pay the requested amount rather than trying to defend a far-off tax court action?

So small online businesses are stunned by the reversal of a long-held ruling that sales tax only need to be paid on sales where the business has a physical presence. What to do? Small online businesses are becoming aligned in an effort urging Congress to step in and create national standards for interstate commerce and supplant the current patchwork quilt of state and local tax laws. Stay tuned!

Larger Businesses … Including Those Seling Online

Companies that have a bricks-and-mortar presence have been unanimous in applauding the SCOTUS decision. Their claim, not entirely without merit, is that they have been operating at a competitive disadvantage. While online sales by small business are dwarfed by the revenues generated by the big guys, they continue to grow steadily and drive a concerted call for a more even playing field and fairer tax legislation.

A statement from Target read in part, “We are pleased the Court’s ruling will close the loophole that has allowed online-only retailers to avoid collecting and remitting sales taxes while still requiring local businesses to do so.”

Interestingly, supporters of the SCOTUS ruling include big online sellers like Amazon, Walmart and Target. While they now frequently collect and remit state taxes, local taxes are rarely if ever included in that effort. So this does add to their tax responsibilities, but they have a massive technology advantage over small sellers so are generally comfortable in dealing with the change.

Note: Technological strength could become a boon for Amazon. It already has the compliance machinery in place and can make it easy for a seller using Amazon’s platform to collect and remit sales tax. Small online retailers may be strongly motivated to engage with Amazon for this immediate resolution to challenges they may not be able to handle financially.

States, Counties and Local Tax Jurisdictions

“Follow the money” is often touted as a sure path to determine motivation. Sales taxes typically range broadly from 1 percent to 10 percent or so. If we think about 5 to 7 percent as a likely jump in added revenue, it’s not a tremendous windfall for the tax collectors.

That said, according to the SCOTUS decision, estimates of sales taxes lost to sellers outside of a jurisdiction run between $8 billion and $33 billion annually. As Senator Dirksen once said, “A billion here and a billion there … soon you’re talking about real money.” Clearly there has been definite support from tax collection jurisdictions for the current ruling.

As evidence of anticipation and desire for the change, many states had already passed laws to trigger tax collection when and if the Supreme Court decided as it did. That means that companies selling into these states are immediately subject to compliance. Again, small businesses will bear the brunt of the need to comply now or run the risk of audits, fines or a decision to withdraw from selling in certain states.

The U. S. Congress

Many major online retailers have joined with small business groups to clarify the SCOTUS ruling and provide a framework that will both defend small businesses while providing uniformity and consistency for all online players regardless of size.

Congress has the authority to resolve the issue of online sales tax fairness, and create a solution that’s uniform across the country. That said it has failed to do so despite repeated introductions of legislation by members of Congress to resolve the issue. Congress’s most robust effort was the Marketplace Fairness Act, which was introduced in the Senate in 2013 and would have authorized states that had met standards for simplified sales tax rules to require large online and catalog retailers to collect sales taxes … notably with significant exemptions to protect small businesses. The Senate passed the MFA with a bipartisan vote of 69 to 27, but it was never brought to a vote in the House.

With this recent SCOTUS ruling and pressure building from the online selling community, perhaps this will be the year when the MFA is reconsidered and passed in some final form that clarifies the current confusion.

Takeaways

Our crystal ball is as cloudy as anyone else’s, but we’re convinced of two things:

- It is likely with the current change as desired by larger online sellers and the potential financial burdens it imposes on the smaller players, Congress will act to resolve the inequities while maintaining a fair and just commercial climate for all.

- Consumers will not be fazed by an added sales tax. They are used to it when going to a bricks-and-mortar store and the convenience plus savings in time and money will continue to accelerate online sales initiated by consumers.